However, the credit card does not allow customers a similar benefit of a cash advance.

The Target RedCard debit card also allows users to withdraw up to $40 in cash along with their purchase. Those with a RedCard also get access to exclusive items and offers.

#Target red card login free#

For example, they both earn a 5% discount on eligible purchases.Ĭustomers also can get free shipping on online orders, including two-day shipping for most items, when they pay with a credit or debit RedCard. There are many similarities between the Target RedCard credit card and the debit card. There are a few differences between RedCard credit cards and debit cards. If you sign up during a special promotion, you can get a bonus reward when you register for the RedCard. Target RedCard offers many benefits, including a 5% discount, extra time for returns, and free shipping on online orders. The Target RedCard also earns a 5% discount on Clearance items, specialty gift cards, Drive Up orders, and delivery orders through Shipt.

Not only can you use your RedCard to earn the 5% discount on regular purchases, but you can also use it at the Target Starbucks locations. You shouldn’t encounter any extra fees if you ensure there are enough funds in your checking account to cover any purchase you make with the RedCard debit card. Depending on where you live, you can be charged up to $40 for a returned payment. The Target RedCard debit card also has a returned payment fee. In addition, if your payment is returned, you could be charged up to $29. There are also fees for late or returned payments for the Target RedCard credit card.Ī late payment can incur up to $40 in late fees. However, the credit card has a 22.9% interest rate for balances not paid by their due date. And if you pay off your balances on time, you shouldn’t encounter any surprising fees. When you sign up for a Target RedCard credit card, you will not have any upfront or annual fees to pay. There is no annual fee for the Target RedCard, and it offers many benefits, including a 5% discount on eligible purchases. The credit card offers a line of credit through TD Bank USA, while the debit card is directly connected to your checking account. Target RedCard is a credit or debit card used for purchases at Target. Have you heard of the REDcard? 👀- Target January 29, 2019

#Target red card login how to#

In this article, we’ll cover what you need to know about saving at Target with the RedCard, including how to apply and use your RedCard. While you cannot use your RedCard with Apple Pay or Google Pay, it can be used with Target Wallet. You can apply for a Target RedCard in-store or online and start using it immediately once approved. The main benefit of RedCard is the 5% discount on eligible purchases. RedCard is a credit or debit card used in Target stores or online. Thankfully, Target offers its shoppers options like the RedCard to save money each time they visit the store or order online. Target is a fun store to shop at, but it can get expensive with all the irresistible products they carry. It doesn't take many drops to make up for any small loses on seasoning purchases.Īlso, for each main/parent card, you need different bank accounts/SSN's but the additional cardholders off that main account doesn't need anything different.Share on Facebook Share on Twitter Share on Pinterest Share on LinkedIn Target may want to see each card get "seasoned" with regular purchases before making a bunch of purchases under the card so I would recommend getting regular items that you already need or can take a small loss on. *For the additional cardholder, you can just use variations of your own name for each one such as John Smith, J Smith, John S, J S, etc.

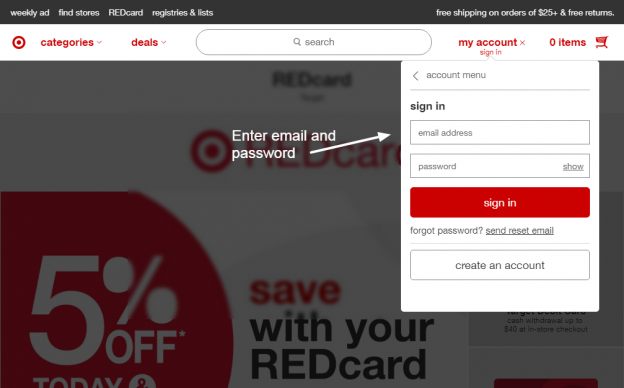

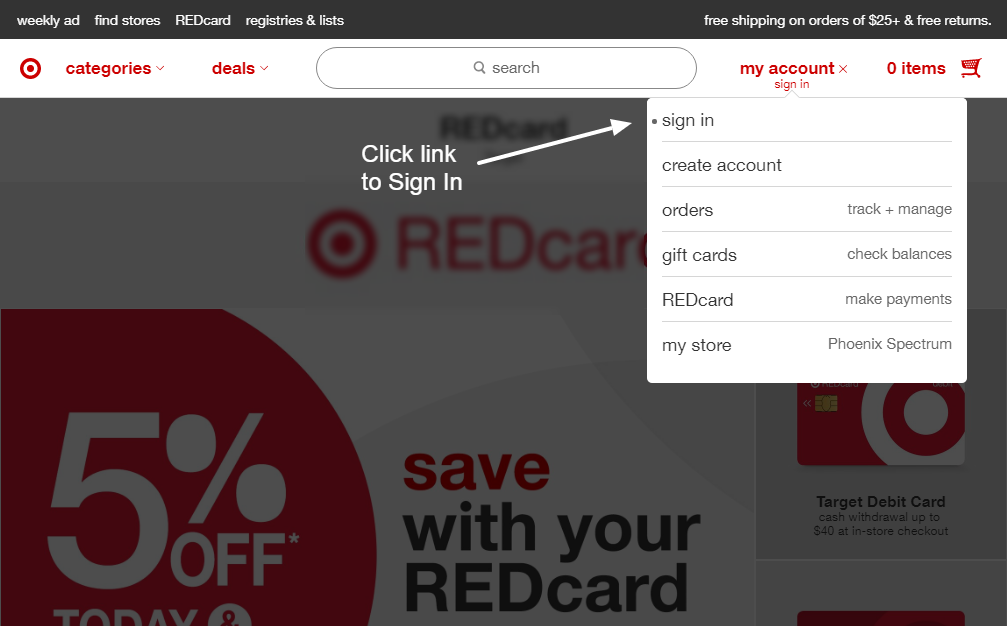

1) If you haven't already, apply for credit/debit version of RedCard:Ģ) Once your the Red Card arrives and is activated, go the the Manage RedCard section or direct link here:ģ) Go to "Settings & Help" and under RedCard Management, go to "Add Cardholder"Ĥ) Add up to 5 additional *cardholders and once they arrive add them to different Target accountsĥ) Repeat steps 1-4 for how many cards you need for your accounts

0 kommentar(er)

0 kommentar(er)